Sensex Falls 15 Points In Early Trade, Stalling A Four-Day Winning Streak

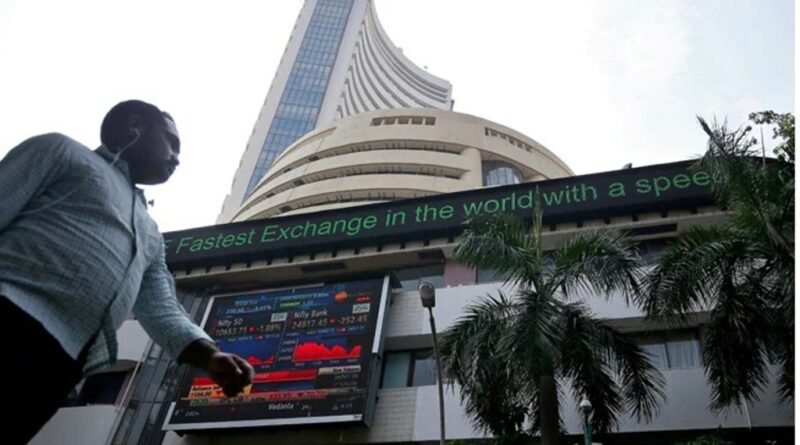

Stock Market India: Equity benchmarks fell in early trade on Mondaytracking the decline in global markets sentiment.

Mumbai November 28 dmanewsdesk: Indian equity benchmarks fell in early trade on Monday tracking the decline in global markets sentiment as a result of demonstrations against China’s strict zero-Covid policy in the country’s major cities.

After demonstrators and police battled in Shanghai on Sunday, concerns over the management of COVID-19 in the second-largest economy in the world caused Asian markets to fall.

The BSE Sensex index fell 15.45 points to 62,278.19, and the broader NSE Nifty index opened lower, reflecting a sea of red in other Asian bourses.

That comes after the Sensex and Nifty had closed at a new record high for the second consecutive day and marking a fourth straight session of gains on Friday.

MSCI’s index of Asia-Pacific shares outside Japan was down 0.6 per cent, after US stocks ended Friday with mild losses. Chinese markets slid as protests erupted in several cities in the country.

Hong Kong shares fell 2 per cent, and the Shanghai Composite index was down 1 per cent.

“Markets could be seen trading lower in early trades Monday in view of weak Asian cues and resurgent safe-haven demand for the US Dollar in the backdrop of China’s increasing covid cases. Due to persisting lockdowns in the dragon country, demand has been slowing resulting in recessionary fears in key global economies,” said Prashanth Tapse, Senior Vice President for Research at Mehta Equities.

“However, the positive takeaway is that the covid concerns are offset by optimism of more support from the Chinese central bank. While intra-day volatility would persist, some positive catalysts such as falling crude oil prices, US dollar index, and better than expected earnings season could keep the markets in good stead,” he added.

The COVID spike and widespread discontent put an end to any short-term market optimism that China’s economy was poised to reopen. Growth will continue to be hindered by the constraints, which don’t appear to be going away anytime soon.

“A growing list of cities, including those with large populations, have imposed strong restrictions on movement because of a surge in infections, there will inevitably be a negative impact on economic activity from the restrictions on movement,” CBA analysts said on Monday.

“Even if China is on a path to eventually move away from its zero-COVID approach, the low level of vaccination among the elderly means the exit is likely to be slow and possibly disorderly. The economic impacts are unlikely to be small.”

Concerns over Chinese economic growth also affected the trading in commodities in Asia.

Brent crude fell to $83 per barrel as a result of concerns that Covid restrictions could slow China’s economic expansion.

American crude fell 0.25 per cent to $76.08 a barrel. A barrel of Brent crude dropped by 0.16 per cent to $83.48.

Last week, both benchmarks fell for a third straight week, reaching 10-month lows.

“Mobility data in China is showing the impact of a resurgence in COVID-19 cases,” ANZ analysts wrote in a research note Monday. “This remains a headwind for oil demand that, combined with weakness in the U.S. dollar, is creating a negative backdrop for oil prices.”

Source: PTI