Kotak sucked into Adani row: Sebi bid to protect banker, claims Hindenburg

This is the first time that the Kotak name has been dragged into the raging controversy that wiped out over $150 billion of the Adani group’s market valuation in February last year but has since been clawed back in a resurgent stock market

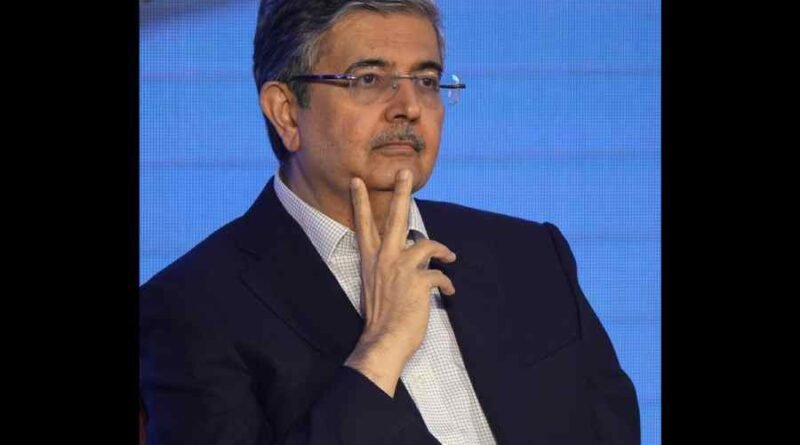

Renowned banker Uday Kotak and the eponymous Kotak Mahindra Bank Ltd have been sucked into the controversial Adani-Hindenburg battle that continues to rage more than 18 months after the first raft of accusations of financial shenanigans against Gautam Adani and his business empire rocked the stock markets in January 2023.

US-based short seller Hindenburg Research has accused market regulator Sebi of trying to protect Uday Kotak and Kotak Bank by failing to explicitly name them in a 46-page showcause notice that the regulator sent to Hindenburg Research for violating its rules by trying to profit from short selling positions that it had taken before coming out with its damning report against the Adani group.

“Kotak Bank, one of India’s largest banks and brokerage firms founded by Uday Kotak,… created and oversaw the offshore fund structure used by our investor partner to bet against Adani,” Hindenburg Research said in its reply to the showcause notice sent by the regulator on June 26.

This is the first time that the Kotak name has been dragged into the raging controversy that wiped out over $150 billion of the Adani group’s market valuation in February last year but has since been clawed back in a resurgent stock market.

Last year, the Supreme Court had ordered Sebi to probe allegations made by Hindenburg Research in its damaging report against the Adani group.

In its reply, Hindenburg Research took the opportunity to take a sideswipe against the market regulator.

The US short seller said the Sebi notice was “concocted to serve a pre-ordained purpose: an attempt to silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India”.

“Much of the notice seemed designed to imply that our legal and disclosed investment stance was something secret or insidious, or to advance novel legal arguments claiming jurisdiction over us… we are a US-based research firm with zero Indian entities, employees, consultants or operations,” the short seller research firm said, suggesting that it was outside the pale of Indian securities law.

“One might think that a securities regulator would be interested in meaningfully pursuing the parties that ran a secret offshore shell empire engaging in billions of dollars of undisclosed related party transactions through public companies while propping up its stocks through undisclosed share ownership via a network of sham investment entities,” it added.

Collusive arrangement

Hindenburg did not name its “investor partner”.

However, the Sebi notice named him as Mark E. Kingdon who routed $40 million into a Mauritius-based Kotak sub-fund called KIOF Class F, which built up a short position of 8.5 lakh shares of Adani Enterprises in the NSE futures market just days before it came out with ₹20,000 crore follow-on public offer that was subsequently withdrawn.

The Sebi showcause notice raised questions about a collusive arrangement among Nathan Anderson, Hindenburg’s sole owner, Mark Kingdon and Kotak entities in deriving gains of ₹183.24 crore (or $22.25 million) through their short-selling positions in the Adani Enterprises stock.

After Hindenburg aired its accusations, the AEL share fell by around 59 per cent between January 24, 2023 and February 22, 2023.

The US short seller said Sebi had “simply named” K-India Opportunities Fund as one of the six “noticees” in the showcause notice.

It also claimed that the regulator had “masked” the “Kotak” name with the acronym “KMIL” — which refers to Kotak Mahindra International Ltd, the Mauritius-based entity.

Downplaying the charge that it had made a lot of money from the short position in Adani Enterprises, Hindenburg said: “We have made about $4.1 million in gross revenue through gains related to Adani shorts from that investor relationship. We made just $31,000 through our own short of Adani US bonds held.”

In a scathing criticism of Sebi’s working, the US research firm said: “Adani is by no means the only lurking and ongoing issue Sebi has failed to address.”

It went on to add: “The message sent to investors in India is equally loud: You have no real protection from fraud. Corporate governance in India is a myth for businessmen that can buy influence.”

“In our view, Sebi has neglected its responsibility, seemingly doing more to protect those perpetrating fraud than to protect the investors being victimised by it,” it added.

Source: The Telegraph online