Investor wealth plunges Rs 2L cr as markets tumble

New Delhi Apr 25PTI: Investor wealth on Friday fell by Rs 2,00,006.26 crore as markets snapped a two-day rally, with the BSE benchmark tumbling 536 points.

“On the domestic front, Franklin Templeton Mutual Fund announced winding up of six debt schemes due to redemption pressure and lack of liquidity in bond markets amid the Covid-19 crisis, which added to the selling pressure,” said Siddhartha Khemka, Head — Retail Research, Motilal Oswal Financial Services Ltd.

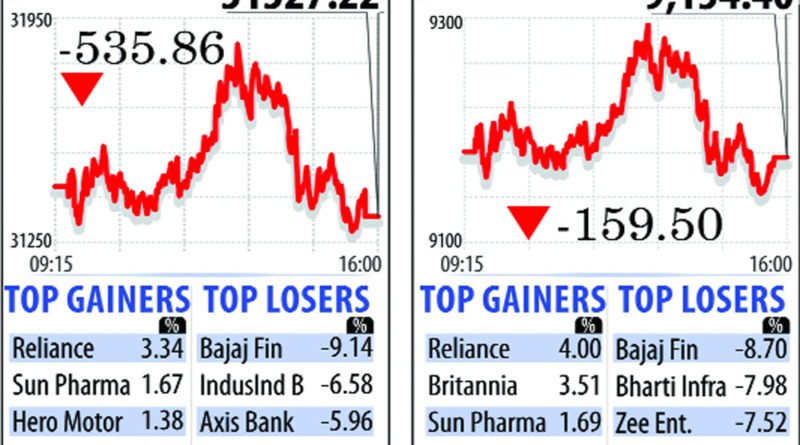

The 30-share BSE Sensex settled 535.86 points or 1.68 per cent down at 31,327.22.

Led by the weak trend in the equity market, the market capitalisation of BSE-listed companies plunged Rs 2,00,006.26 crore to Rs 1,21,73,452.47 crore.

Franklin Templeton Mutual Fund late on Thursday announced winding up of six debt schemes, with assets under management of over Rs 25,000 crore, due to redemption pressures and lack of liquidity in bond markets amid the COVID-19 crisis.

The biggest drag in the Sensex pack were bank and finance stocks, led by Bajaj Finance which was the worst hit among the 30-share components, falling 9.14 per cent, followed by IndusInd Bank (6.58 per cent), Axis Bank (5.96 per cent), ICICI Bank (5.09 per cent) and HDFC (5 per cent).

In the broader market, the BSE midcap and smallcap indices fell up to 1.77 per cent. On the BSE 1,617 companies declined, while 746 advanced and 155 remained unchanged.

“Today, Nifty opened with a sharp gap-down due to negative global cues and news of Franklin Templeton AMC’s decision to close six debt funds. As a result, NBFC and banking stocks were under pressure,” Vishal Wagh, Research Head, BONANZA PORTFOLIO said.